You could save over $280¹ with the Newcomer Banking Plan.

Start your financial journey in Canada by opening a chequing account and an enviro™ Visa* credit card with Vancity — we’re here to help you settle in with confidence.

Account with no monthly fee for 2 years¹

Credit card with limit of $3,500²

Meet with us today to sign up:

Get the planNewcomer Banking Plan details.

Great benefits waiting for you.

Open a Newcomer Banking Plan by appointment today and you’ll get all the features of our Essential Chequing Account along with these benefits:

-

Monthly fee waived for 2 years

Enjoy the first two years free of monthly fees ($9.75) with no minimum balance requirement, a great way to ease into your new financial routine. -

25 free Everyday Transactions per month¤

Including Everyday In-Person, Debit, Cheque, ATM, and Interac e-Transfers®. -

Free first cheque order and bank draft

Just a few ways we make settling in Canada a little easier. -

Free online and mobile banking

Transfer between accounts, pay bills and deposit cheques from anywhere. -

Access 4,000+ ding-free® ATMs

Take out money across Canada with no surcharge at The Exchange and Acculink ATMs.

You may be eligible if:

- You have come to Canada within the past 5 years

- You are at least 19 years old and a resident of BC

See terms & conditions for full details on this offer.

Spend with convenience & earn rewards.

We’ve made it easy for you to get the credit card you want — even without credit history in Canada.³

Join Vancity today through a Newcomer appointment and you may be eligible for any of our personal credit cards with a newcomer credit limit of $3,500.²

Features we love.

- No annual fee options⁴

- Earn rewards for cashback⁵, travel, and more

- Canadian credit history not required³

- Use it to build your credit history

- Newcomer credit limits to help you settle in²

You may be eligible if:²

- You are or become a Vancity member at the time of application⁶

- You have verifiable income like pay stubs, proof of payroll deposits etc.⁷ Select cards may have additional income requirements††

- You are at least 19 years old

To be eligible to receive the Newcomer benefits, you must apply by appointment.

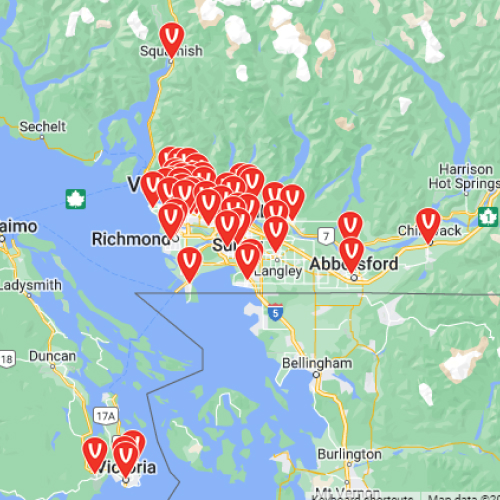

Find Vancity outside of Vancouver.

Vancity is one of Canada’s largest credit unions with 54 locations throughout the Lower Mainland and Vancouver Island. You can find us in cities including:

- Vancouver

- Surrey

- Burnaby

- Richmond

- Coquitlam

- Victoria

- And 8 more municipalities!

Outside of our branches, Vancity members can also access over 1000+ ATMs free throughout Canada.

Get your credentials recognized.

Are you coming to Canada as a trained professional? If you’re seeking to have your credentials recognized in Canada, you can find financial support through the Foreign Credential Recognition loan.

Some examples of professions that can apply for the loan include:

Looking for more?

We have what you need. Vancity is a full service, values-based, financial institution offering personal banking, investments, loans, mortgages and business banking solutions.

Tell us where you’re in your journey, and we’ll show you the way:

Exchange currency and transfer money

- Send and receive wire transfers

- Exchange foreign currency

- Free CAD transfers between Vancity members

Learn about banking in Canada

- Find out how to send and receive money in Canada

- Discover why credit cards are so popular with Canadians

- Learn how to protect yourself from scams and fraud

Learn about credit cards and credit score

- Learn how to build your credit score

- Find out how interest is charged

- Set up alerts and automatic payments

Get credentials recognized

- Borrow to have your professional or trades credentials recognized in Canada

- Pay for courses, certification or living expenses while you attend school

Buy a home

- Meet with our multilingual mortgage specialist team

- Choose from a variety of length and rate options

- Get special mortgages for construction

Start your investments

- Receive tax-free or tax sheltered benefits through registered accounts like TFSA, RRSP, RESP, RRIF, RDSP

- Choose from mutual funds, bonds, stocks, term deposits and more

- Invest online or through a professional

Set up your business

- Find solutions for businesses of all shapes and sizes

- Including accounts, financing, point of sale and more!

View legal details

* Trademark of Visa Int. Used under license.

†† Eligibility for a Visa Infinite* card is subject to meeting minimum annual income requirements: $60,000 annual personal income, $100,000 annual household income, or $250,000 or more in investible funds. Eligibility for a Visa Infinite Privilege* card is subject to meeting minimum annual income requirements, as follows: $150,000 annual personal income, $200,000 annual household income, or $400,000 or more in investible funds.

¤Everyday transactions are all of these:

- Everyday Cheque and Preauthorized Payment Transactions are cheque transactions and preauthorized payments (PADs) from Vancity Accounts.

- Everyday Online and Mobile Transactions are bill payments, cheque deposit using Vancity Mobile Deposit™, transfers from Vancity Accounts made online using a computer, mobile phone, Mobile Device or using Vancity’s automated Telephone Banking service.

- Everyday In-Person Transactions are Account withdrawals, bill payments, transfers to or from Vancity Accounts conducted person-to-person, over the phone with our branch staff or Member Service Centre staff.

- Everyday Debit Card Transactions are debit card purchases or ATM cash withdrawals or ATM transfers from Accounts.

Everyday Transaction fees are calculated and charged at month-end for Vancity’s chequing and savings products, with the exception of Jumpstart High Interest where the fees are incurred immediately when the transaction is made. Overdraft interest, not covered by a Creditline line of credit or a Personaline line of credit, accrues immediately and will be calculated and payable at month-end.

Additional Vancity and third-party fees will apply for services not classified as Everyday Transactions and, in certain circumstances, include fees for: a) ATM network fees if you use any Canadian ATM that is not an Exchange® ATM or ACCULINK® ATM. b) ATM network fees if you use a US/international ATM. c) INTERAC® e-Transfers that are subject to a fee. d) Fees for additional services that you choose from Vancity.

You may also be charged third-party fees including: e) A surcharge (convenience fee, and/or a foreign exchange conversion fee) by the ATM or POS operator and all associated networks engaged for the ATM or POS Transactions. f) Merchant fees when you use your debit card to pay for purchases. g) Fees charged by your mobile phone service provider; please request details from your service provider.

For a full list of fees, see the Personal Service Charge Bulletin.

¹ See full terms and conditions. Your savings may vary and could be less than $283.95. You may experience no savings. Value of savings totaling $283.95 is calculated as follows: monthly fee of Essential Chequing account of $9.75 x 24 months ($234), one bank draft at $9.95 and one book of 50 cheques starting at $40. If you open an Essential Chequing Account maintain a balance of $1,500 or more throughout the offer period, do not order cheques or a bank draft, your savings would be $0. For more information about our fees, please see our Personal Service Charge Bulletin.

² See terms and conditions for definitions and requirements of credit card applicants. Vancity may offer credit limits lower than $3,500, in its discretion, depending upon assessment of your application and evidence of income, assets and general credit worthiness provided, including but not limited to evidence of employment and income.

³ Canadian credit history is not a requirement. However, Vancity will obtain your Canadian credit bureau report to confirm eligibility and if you have a Canadian credit score it will be considered in assessing your eligibility for credit under this program.

⁴ See all credit card options. Business Visa cards are excluded from the Vancity Newcomer Banking Plan. The Newcomers to Canada Visa Card Program applies only to personal Visa Cards used for personal (non-business) expenditures. If you require a Visa for business use, please let us know and we can discuss other options that may be available to you.

⁵ Vancity membership required to obtain certain cash back rewards. Must have a Vancity deposit account to redeem for cash back. Additional terms and conditions apply.

⁶ See Vancity Newcomer Banking Plan terms and conditions for information about becoming a Vancity member

⁷ Documentation may be required to support proof of income.