What is a credit union?

Bank where you’re an owner.

A credit union is a financial institution that is owned, governed, and supported by members, unlike traditional banks. Every person of legal age who opens an account becomes a part-owner with a voice in how we operate. At Vancity, we exist to serve our members, with decisions driven by community needs and profits reinvested.

Our members hold real power.

Every member, regardless of how much money they’ve deposited, has an equal vote in key decisions, ensuring we operate in the best interest of our community. As a member you can:

Guide the direction of our credit union

Propose and vote on important matters at our Annual General Meeting. For example, in 2025 members voted on Board of Directors’ compensation.

Vote and elect leaders

Choose or even run for our Board of Directors — a group of fellow members who guide the credit union’s direction, values, and strategy.

Nominate candidates

Nominate Board candidates or take part in committee that selects candidates for the ballot during the elections process.

Share in profits

Celebrate our achievements through Shared Success where 30% of our profits go back to our members and the community.

Founded on change.

Bold individuals dared to defy the status quo. Shut out by banks that wouldn’t lend east of Cambie, they didn’t wait for change. They built a credit union grounded in inclusion, community, and member ownership. Since 1946, Vancity set out to do banking differently — not just for profit, but for people.

Canadian credit unions were established in the early 20th century, emerging at a time when banks made it difficult for the average citizen to borrow or invest. In the early days most credit unions formed around a common bond, such as a workplace, trade, church or ethnic affiliation. This made sense given that the original idea behind credit unions was to lend money on the basis of character rather than wealth or property. The common-bond credit unions increased access to credit, but left out those who didn't belong to one of these groups.

Soon a few credit union activists began promoting the idea of an open or community-based credit union in Vancouver that would allow any resident of the city to join. Although it was a rather unorthodox idea at the time, supporters of the idea were passionate.

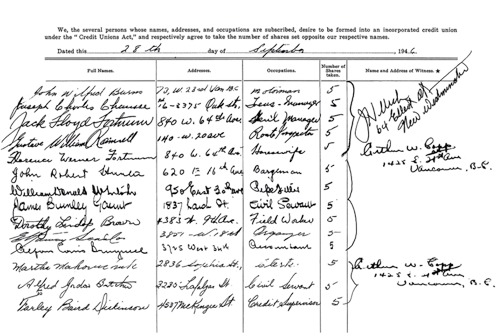

On September 28, 1946, 14 Vancouverites signed a charter to establish an open-bond credit union called Vancouver City Savings Credit Union. About two weeks later—October 11, 1946—the credit union became official.